Coal mining plays an important role in the energy stability of our country. Coal as a natural resource is used for the electricity production by thermal stations, in chemical production, in ferrous metallurgy, in transport, as well as in heating buildings in the winter season. The reserve of this solid fuel is estimated to last for no longer than 100 years [1].

Mining enterprises, in spite of such prospects in their activities, also have internal development problems. Their essence lies in the factors of production activity (PA), one of which is the basic production assets (BPA). The analysis of the production activity of the enterprise under our study showed that the state of the BPA does not fully meet modern technical and economic requirements. This reduces the overall effectiveness of the other factors of production and the operation of the enterprise as a whole.

We considered such factors of production activity as labor resources (LR) and natural resources (NR), enterprise capital (EC) and entrepreneurial skills (ES), the latter – in relation to management personnel.

The analysis of the enterprise’s labor resources showed that the payroll is 17,000 employees. According to the occupational qualification groups, they are distributed as follows: workers – 14.0 thousand people; managers, specialists and office workers – 3.0 thousand people [2].

In the course of conducting the anti-crisis audit, in order to improve the performance of the PA factor, the management and administration of the company were proposed to create conditions at the enterprise for the maximum realization of the labor potential of employees. The essence of these measures is to improve the organization of labor and production, to increase the technical level of production, to improve labor management in order to enhance the quality of the “human factor” and its production efficiency.

The main natural resource of the enterprise is coal.

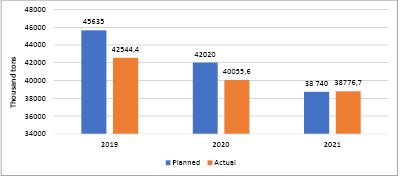

It is worth considering the company’s coal production indicator for 3 years (2019-2021) in more detail. The results are given in table 1.

Coal production volume: according to the plan for 2021, it was expected to produce 38,740 thousand tons of coal. However, the actual production volume amounted to 38,776.7 thousand tons (+37 thousand tons or 100.1% of the plan). The target for 2021 exceeded by 0.1%. Relatively the level of 2020, the Coal Company decreased coal production by 1,278.9 thousand tons. In 2019, there was also a decrease in production volume. The decline in coal production was caused by the unfavorable situation in the coal market due to a sharp drop in prices and demand for high-volatile coal. In Figure, you can clearly see the annual decline in coal production.

One of the most important indicators is the quality of mined coal. The results for 2019-2021 are presented in table 2.

Since the range of coal products use is very wide, the place of the shipment of coal is determined by its quality. In order to determine the quality of the mined coal, experts consider more than 30 different indicators. The most important indicators of the quality of mined coal are: ash content, moisture content, sulfur presence, volatile content, calorific value and thermal equivalent of marketable coal.

Table 1

Indicators of coal production volumes for 2019 – 2021

|

Indicator |

Unit of measurement |

Indicator value |

|||||

|

2020 |

2021 |

||||||

|

expected |

actual |

expected |

actual |

expected |

actual |

||

|

Mining |

thousand tons |

45,635 |

42,544.4 |

42,020 |

40,055.6 |

38,740 |

38,776.7 |

The company’s coal production indicators in 2019 – 2021

The company has its own technical control department at each branch, where laboratory specialists take samples for testing at all production stages: from a slaughter to a storage. This multi-level control helps the company make rational decisions about coal quality.

In 2021, the volume of marketable coal (without rock and losses in the course of enrichment) amounted to 36,162.3 thousand tons. This is 578.6 thousand tons less than in 2020.

The quality of marketable coal in 2021 compared to 2020 declined in the following indicators: ash content, volatile output. But in general, the indicators of the quality of commercial coal are satisfactory.

The company’s development strategy is aimed at further enhancement of the quality and competitiveness of the products, as well as a gradual increase in annual production up to 60 million tons of coal by 2035. The analysis of this PA factor showed that such volumes of coal production for the enterprise are quite realistic under implementation of the plans on the development of new coal sites, construction of facilities for the coal processing and enrichment and modernization of coal mining in general. This was reflected within the framework of measures to improve the performance of this factor in PA [3].

The assets used for coal mining represent the capital of the enterprise. Table 3 provides the analysis of capital for 2019 – 2021. Primarily, it should be noted that most of the indicators do not correspond to the norm or take a neutral value. It is necessary to analyze the values calculated for each group.

Indicators of financial stability. For the entire period from 2019-2021, the coefficient of inventories provision wi0th equity funds had a negative trend. The long-term borrowing ratio was in line with the norm only in 2020, as well as the financial stability ratio. Most indicators of financial stability had a positive trend. The enterprise did not depend on external creditors – this was indicated by the value of the autonomy coefficient, which corresponded to the norm.

It can be seen that the coefficient of long-term borrowing decreased every year, whereas the autonomy coefficient, on the contrary, increased. This indicates that the stability of the enterprise was normal.

Profitability indicators indicate the economic efficiency of the enterprise: the higher the profitability, the more successful the company operates. If the profitability is low, the further work and existence of the company does not make sense. In 2020, the most important indicator – return on equity showed negative values. For investors, this is the most important indicator, since if it is negative, all investors will incur losses.

Table 2

Quality of mined marketable coal

|

Period |

Marketable coal |

Ash content |

Moisture |

Sulfur |

Volatiles |

Heat of combustion, kcal/kg |

Heat equivalent |

|

|

thousand tons |

Ad, % |

W r, % |

Std, % |

Vdaf, % |

Higher, Qsdaf |

Inferior, Qir |

||

|

2021 |

36,162.3 |

12.1 |

9.1 |

0.3 |

28.8 |

8,142 |

6,242 |

0.893 |

|

2020 |

36,740.9 |

12.4 |

9 |

0.3 |

29.6 |

8,135 |

6,239 |

0.891 |

|

2019 |

39,302.1 |

12.7 |

9.2 |

0.3 |

28.8 |

8,137 |

6,197 |

0.885 |

|

(+/-)2021 to 2020 |

-578.6 |

-0.3 |

0.1 |

0 |

-0.8 |

7 |

3 |

0.002 |

|

(+/-)2021 to 2019 |

-3,140 |

-0.6 |

-0.1 |

0 |

0 |

5 |

45 |

0.008 |

|

(+/-)2020 to 2019 |

-2,561 |

-0.3 |

-0.2 |

0 |

0.8 |

-2 |

42 |

0.006 |

Table 3

Analysis of the company’s capital for 2019 – 2021

|

Index |

Indicator value |

Norm of indicators |

||

|

2019 |

2020 |

2021 |

||

|

Autonomy coefficient |

0.42 |

0.40 |

0.53 |

>0.5 |

|

Equity ratio |

- 0.80 |

-0.93 |

0.04 |

>0.1 |

|

Capital stock ratio |

-3.89 |

-5.97 |

-7.35 |

0.6 – 0.8 |

|

Fixed asset ratio |

1.62 |

1.73 |

0.97 |

0.5 – 0.8 |

|

Long-term borrowing ratio |

0.36 |

0.51 |

0.29 |

0.5 – 0.7 |

|

Financial stability ratio |

0.66 |

0.81 |

0.75 |

0.8 – 0.9 |

Table 4

Indicators of return on capital for 2019-2021

|

Index |

Indicator value |

Norm of indicators |

||

|

2019 |

2020 |

2021 |

||

|

Return on assets |

-0.003 |

-0.06 |

0.29 |

- |

|

Profitability of sales |

-0.003 |

-0.06 |

0.21 |

- |

|

Profitability of products |

0.006 |

0.12 |

-0.95 |

- |

|

Return on equity |

-0.007 |

-0.16 |

0.54 |

- |

In 2019-2020 year, the profitability of production had a positive value. This can be explained by the fact that the company earned a small profit from each ruble spent on coal mining. But, in 2021, there was a negative trend in this indicator. This was due to the increase in coal mining costs. The main reason for the negative values of the return on equity in 2019-2020 was the negative values of the return on sales, which were caused by incurred losses. The return on equity is higher when the ratio of total debt to total assets is greater. Thus, we can conclude that the return on equity increases along with the growth in loans and borrowings. Thereby this is a negative trend for the organization.

The set of measures were recommended the enterprise to improve the performance of the PA factor include the following approaches: to increase the amount of equity, to reduce the accounts payable, competently manage accounts receivable, fixed assets and cash.

As it is necessary to ensure the functioning of a coal mining enterprise in the future, entrepreneurial skills were investigated. In fact, entrepreneurial skills are the ability of the management personnel to competently manage the enterprise in certain conditions. The set of measures necessary to achieve this goal includes the following: in order to earn more profit, reasonable risks have to be taken. At the same time, it should be understood that PA at the enterprise achieves the desired economic effect if new technologies and materials are introduced into the production process, new contracts with customers are concluded, investment activity is arranged to develop new coal deposits in the region.

Thus, in our opinion, the considered PA factors and measures to improve their performance in the functioning of the investigated coal mining enterprise become the objective basis for its future development within the territorial production complex of Kuzbass.

Библиографическая ссылка

Gureva A.A., Popova N.B., Zharikova E.G. FACTORS OF PRODUCTION ACTIVITY OF THE MINING ENTERPRISE IN THE KEMEROVO REGION-KUZBASS // Материалы МСНК "Студенческий научный форум 2025". 2023. № 14. С. 110-113;URL: https://publish2020.scienceforum.ru/ru/article/view?id=753 (дата обращения: 02.02.2026).